Are you ready to revamp your wardrobe? Do you want to make stylish choices that align with ethical and sustainable practices? Then, picking the right fast fashion brand is crucial to ensure your closet stays trendy, affordable, AND environmentally conscious.

The fast fashion industry is diverse, with brands varying widely in terms of their impact on our planet and overall ethical standards. In light of this, we’ve compiled a 2023 Fashion Index, highlighting the highest and lowest-ranked brands based on various factors.

From evaluating their sustainability practices to monitoring their labor conditions and animal welfare policies— our comprehensive guide will help you choose better. Whether you’re aiming for budget-friendly chic looks or seeking to support ethics in the fashion world, this index will guide you in making informed choices for your next 2023 style adventure!

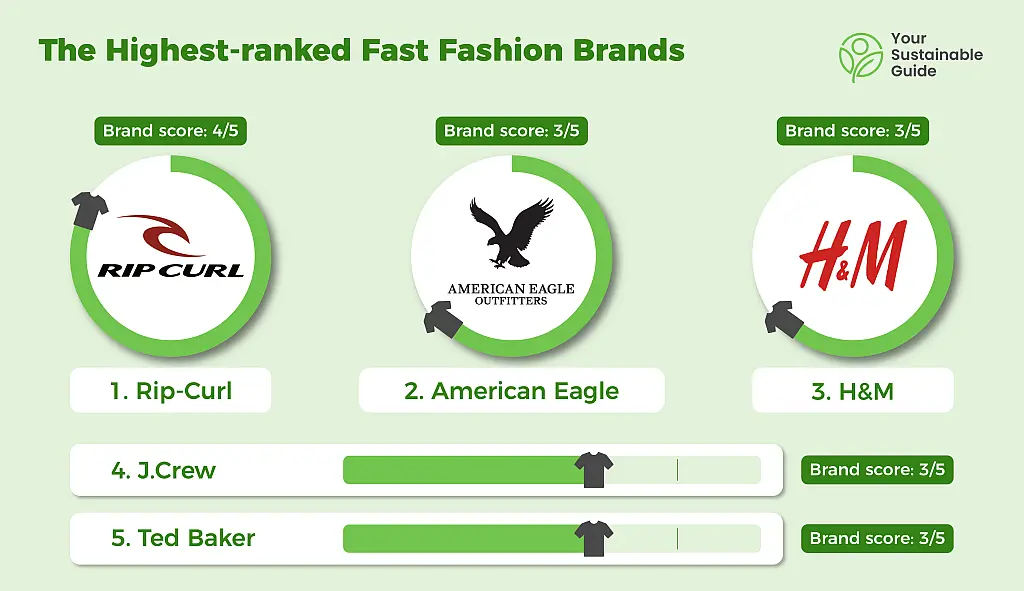

The Highest-ranked Fast Fashion Brands

1. RIP CURL

RIP CURL tops the list of our highest-ranked fast fashion brands with a score of 4 out of 5. The age-old surf-inspired clothing company offers throngs of amazing wetsuits, swimwear and beachy clothes among its other collections for men, women and kids.

RIP CURL uses a good proportion of quality materials, including recycled fabrics, and every garment is well-made to last you. Also, it has strong animal welfare policies. Only a few of its products are made from wool and down, which are responsibly sourced. Additionally, RIP CURL has introduced the “Wetsuit Recycling Program” and has already recycled more than 20,000 wetsuits. It has partnered with Airstep in Melbourne, sending 50% of its wetsuit offcut waste to be transformed into carpet underlay.

As a B Corporation, RIP CURL takes its social compliance quite seriously. It publishes its manufacturing facilities’ list to maintain transparency with consumers. While all of its factories are not certified, the label works with a third-party auditor to regularly audit its factories to ensure fair trade standards are observed. Plus, it gives back to the local community in various ways.

2. American Eagle

Securing 2nd place among the highest-ranked fast fashion brands is the good ol’ American Eagle. The brand has scored an average of 3 out of 5 for making commendable efforts to do business more responsibly. Its diverse range of youthful clothing, including denim, outerwear, intimates, activewear, and more, is specifically tailored for the Gen Z audience.

When it comes to being eco-conscious, American Eagle has formulated several sustainability programs. To start with, it has added a lot of green materials to its collections, like BCI organic cotton, recycled polyester, and natural dyes. Plus, by 2023, its goal is to use 100% sustainable cotton. It is also a part of the Sustainable Apparel Coalition (SAC) and started a Water Leadership Program in its denim factories to reduce water use.

American Eagle strictly prohibits animal cruelty and only uses certified leather, alpaca, and down in its products. As the company operates on a complex supply chain, it has mapped out a strict Code of Conduct for its suppliers. However, there is ample scope for improvement if it aims to become 100% ethical.

3. H&M

Shocked to see the fast fashion giant as our 3rd highest-ranked fashion brand? Well, believe it or not, H&M has pulled up its socks in its attempts to become environmentally friendly. With a score of 3 out of 5, this Swedish retailer is a go-to shopping spot for consumers worldwide. Its vast array of menswear, womenswear, accessories, and home decor is designed to attract budget-friendly shoppers, no matter your age group or style preference.

H&M has been called out for being one of the top polluters of the fashion industry. However, the brand is mending its ways by implementing several green initiatives. For starters, many of its garments are made from natural and recycled materials. It has also introduced a recycling program where consumers can drop their unused garments in H&M’s stores in return for store credits. Of course, it needs to do more to become fully sustainable, but we appreciate the start.

Furthermore, H&M is striving to channel a ‘fair and just’ supply chain after being repeatedly tied to several unethical practices. It has laid out a robust Code of Conduct for its manufacturers and has shown incredible transparency by publishing its suppliers list. H&M definitely has a long way to go to become a responsible business, and we can only hope it does better from here.

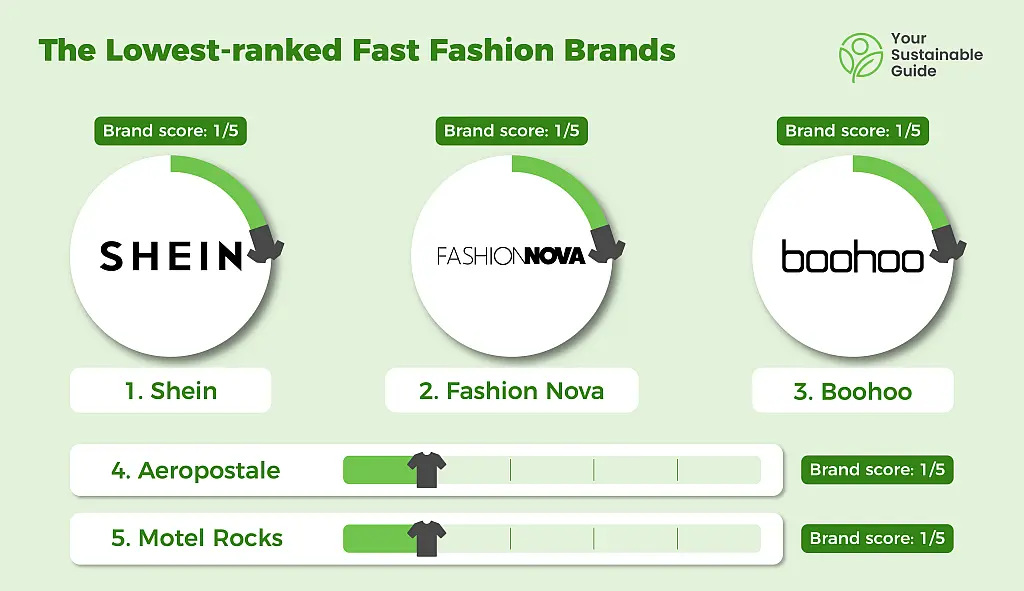

The Lowest-ranked Fast Fashion Brands

1. Shein

Topping the list of lowest-ranked fast fashion brands is none other than Shein. This ultra-fast fashion behemoth is gaining popularity for its super-trendy, affordable collections, taking over long-standing giants like H&M and Zara. With the lowest score of 1 out of 5, Shein sells tonnes of cheaply-made garments and accessories that scream fashion but are polluting the planet.

Shein primarily uses unsustainable materials like polyester, nylon, acrylic, and rayon to manufacture its clothing. It drops hundreds of styles every week, pushing people to chase the latest trends. And as the products are priced at rock-bottom rates, consumers are tempted to shop more and more. The brand is a major contributor to the ‘throwaway’ culture, where people barely wear its garments once or twice before discarding them and jumping on to the next trend. Overall, Shein is engaging in actions that contribute to making our planet unlivable.

Furthermore, no one knows where Shein’s garments are manufactured, apart from the fact that its entire supply chain is based in China. Over the years, many cases of sweatshop production have surfaced where Shein’s workers were found to work under deplorable conditions. But the Chinese retailer doesn’t bother to maintain transparency or protect its people or show some concern towards the environment.

2. Fashion Nova

Next in the line of lowest-ranked fast fashion brands had to be Fashion Nova, with a score of 1 out of 5. Offering hordes of spicey dresses, skimpy tops, and everything in between, this fast fashion label churns out 26-trend-oriented collections annually. It creates rip-offs of runway trends and celeb styles at affordable prices, making it a sensation among fashionistas.

In order to keep the prices low, Fashion Nova heavily uses unsustainable fabrics like polyester, latex, lycra, and everything that contributes to environmental pollution. It neither controls its production scale nor has any plans to reduce its carbon footprint. In short, it doesn’t make any efforts to become sustainable.

Fashion Nova’s supply chain reveals another dark side of the fast fashion industry that thrives by exploiting underprivileged garment makers. The US-based brand employs low-grade uncertified factories and turns a blind eye to the unfair trade practices followed there. Because all it has ever cared about is to make profits by flashing tempting price tags.

3. Boohoo

Coming in at the third spot for lowest-ranked fast fashion brands is Boohoo. Scoring as low as 1 out of 5, Boohoo has acquired a massive spot in the garment industry by quickly adapting to changing fashion trends. It offers a plethora of voguish apparel and accessories that match current styles and keep pricing reasonable, combining affordability with fashion. But despite its recognition as a prominent clothing company favored by Gen Z and millennials, it does little to give back to the planet.

Nearly 50% of Boohoo’s clothing is made in the UK, especially in shady factories of Leicester and Manchester. The remaining half is outsourced to factories located in China, Bangladesh and various other developing Asian nations, where labor law violations are common occurrences. Boohoo has violated several labor laws in the past, using sweatshops where workers were underpaid and subjected to long hours. And while it claims of taking steps to enhance working conditions in its factory, there is no evidence to support this statement.

Moreover, Boohoo uses a good amount of high-impact materials like conventional cotton, polyester, nylon, viscose, and acrylic. It has been criticized for its wasteful practices and insufficient evidence to back up its environmental and social impact claims. The positive aspect is, Boohoo is trying to be sustainable by introducing a sustainability plan, “UP.FRONT”. It has also joined well-known third-party groups like the Sustainable Apparel Coalition, the UK Sustainable Clothing Action Plan, and others. But, undoubtedly, the retailer still has a long way to go to become a truly responsible business.

The Highest-Earning Fast Fashion Brands

1. Shekou

Topping the list of the highest-earning fast fashion brands is Shekou, with 26.78 million in revenue. Launched in 2019, Shekou has experienced a remarkable ascent, ruling as the money-making machine of the fast fashion market in 2023. This success can be attributed to a combination of innovative business models, strategic approaches, and effective marketing techniques.

Shekou‘s business model revolves around a rapid production cycle, enabling the brand to quickly respond to emerging fashion trends. It has implemented strategies that focus on scalability and adaptability. Moreover, it has a strong online presence, leveraging social media platforms like TikTok, Instagram, and YouTube to connect with a global audience. Collaborations with influencers play a crucial role in expanding the brand’s reach and establishing its dominance in the fast fashion landscape.

2. Zara

Running second among the highest-earning fast fashion brands is the ever-popular Zara, with a whopping 25.44 million in revenue. Operating successfully for decades, Zara is loved for its voguish designs, attractive storefronts, and frequent product releases.

Zara excels by swiftly producing on-trend styles and strategically advertising them. It keeps a keen eye on high-end runway trends and celeb culture and rapidly introduces affordable alternatives. With a staggering release of over 20,000 fresh styles annually, Zara encourages a dynamic and frequent shopping experience for consumers.

Zara’s success is deeply intertwined with its focus on consumer engagement. By offering a constant stream of fresh styles and limited-time availability, the brand encourages a sense of urgency, driving consumers to frequent its stores and online platforms. Its marketing techniques are characterized by a seamless blend of in-store and online experiences. Furthermore, it utilizes the power of social media by showcasing new collections, engaging with consumers, and creating a buzz around its rapidly changing inventory.

3. H&M

Ranking third among the highest-earning fast fashion brands is H&M, with 22.250 million. H&M’s business model centers around a commitment to delivering fashionable clothing at affordable prices. Its success is rooted in an agile and efficient supply chain, allowing it to respond rapidly to changing fashion trends and consumer preferences.

H&M’s strategies encompass diverse initiatives, including collaborations with high-profile designers and influencers, continuous product diversification, and a solid online presence. H&M’s commitment to providing a wide range of styles for various demographics further contributes to its widespread consumer base.

H&M leverages a multi-channel marketing approach, combining traditional advertising with a strong online presence. With active engagement on social media platforms, strategic partnerships, and influencer collaborations, H&M maintains relevance and stays connected with its target audience.

The Most Searched Fast Fashion Brands

1. Shein

Shein takes the crown as the most searched fast fashion brand in 2023, with an average search volume of 8,670,000, according to our research based on Ahrefs data. This unparalleled success is the result of an innovative business model, strategic production processes, and cutting-edge promotional techniques. Its operations revolve around the concept of “fast fashion on a budget.” By providing fashion-forward and budget-friendly clothing options, the brand has captured the attention of a vast and diverse consumer base.

Shein’s target audience primarily includes teenagers and Gen Z, who are keen on staying up-to-date with the latest fashion trends without breaking the bank. Shoppers appreciate the brand’s quick response to the latest runway styles, allowing them to stay ahead in the fashion game. Furthermore, it actively engages with its customers through promotions, discounts, and interactive campaigns.

Shein has mastered the art of digital marketing and e-commerce. The brand heavily invests in online platforms, leveraging social media channels, influencers, and user-generated content to create a buzz around its products. Shein’s marketing strategy includes targeted advertisements, influencer collaborations, and a user-friendly online shopping experience, contributing to its widespread recognition and popularity.

2. Old Navy

As per our research based on Ahrefs data, Old Navy ranks as the second most searched fast fashion brand in 2023, with an average search volume of 7,150,000. Old Navy positions itself as a family-friendly, inclusive brand with a broad target customer base. It caters to men, women, and children, making it a one-stop-shop for families looking affordable and versatile clothing options.

Old Navy’s target audience includes individuals who prioritize value, quality, and a diverse range of styles for the entire family. Its popularity stems from its widespread appeal and reliability. It has gained a loyal customer base due to its family-centric approach, offering clothing options for every age group.

In addition, Old Navy’s strategic positioning in the mid-tier market, providing quality at affordable prices, contributes to its popularity among cost-conscious consumers. The brand’s consistency in delivering a mix of timeless and on-trend styles, combined with its presence in both physical stores and online platforms, enhances accessibility and customer reach.

3. American Eagle

Finally taking the spot of the third most searched fast fashion brands is American Eagle. It scored a search volume of 1,960,000 million. American Eagle targets a youthful and casual customer base, primarily focusing on teenagers and young adults. The brand is a go-to destination for those who value comfort, individuality, and a relaxed style. It has a loyal customer base who appreciate fashion that seamlessly blends comfort with trendiness. That’s why it is a popular choice among the youth looking for casual and laid-back clothing options.

American Eagle is known for its commitment to comfortable and well-fitted clothing, offering a range of sizes and styles that cater to every body type. The quality of materials and craftsmanship in American Eagle’s products contributes to its appeal, ensuring that buyers receive durable and lasting pieces.

American Eagle’s denim collection, in particular, has garnered praise for its variety, fit, and inclusivity. Additionally, the brand’s marketing often emphasizes a body-positive image, fostering a sense of inclusivity and resonating with buyers seeking authenticity and relatability in the fashion industry. Its success is further bolstered by its strategic use of digital marketing, engaging with its audience through social media platforms and influencer collaborations.

Our Methodology

Selection of Top 50 Fast Fashion Brands Based on Revenue

Our methodology in identifying the Top 50 Fast Fashion Brands based on Revenue/Earnings was a meticulous process. It started with pinpointing the top 50 fast fashion brands using their revenue or earnings as the primary criteria. The first step involved a thorough examination of the detailed financial results disclosed by these brands on their official websites. To ensure a comprehensive overview, we gathered additional information from credible financial newspapers, publications, and US government websites, including the Securities and Exchange Commission.

For private companies where direct financial information wasn’t publicly accessible, we turned to estimated data from reliable e-commerce databases. This approach was designed to maintain accuracy while offering a broader understanding of the market leaders in the fast fashion industry. In essence, the methodology combined direct data from the brands themselves with information from reputable external sources to create a well-rounded picture of the top players in the fast fashion sector based on their revenue and earnings.

Brand Scoring System

Our Brand Scoring System was designed to evaluate companies holistically, considering other important factors beyond just financial performance. Each brand underwent a scoring system ranging from 1 to 5, where 1 represented ‘Poor’ and 5 denoted ‘Excellent’. The scoring criteria covered essential aspects such as Sustainability, Labor Practices, Ethical Sourcing, Use of Child Labor, Animal Cruelty, policies related to Giving Back to the community/environment, and commitment to Fair Trade practices.

To assess these criteria, a thorough examination of brand assets was conducted, focusing on their ethical, sustainable, and community give-back initiatives. This involved scrutinizing the brands’ self-reported practices and achievements in these areas, providing a firsthand understanding of their commitment to ethical standards.

In addition to relying on brand-provided information, a dual approach was employed. We researched news articles and gathered information on any malpractices or controversies associated with the brands. This combination of self-reported data and external scrutiny ensured a balanced and comprehensive assessment of each label’s dedication to ethical practices and social responsibility. The result was a nuanced understanding of how each brand performed across various ethical and sustainable dimensions, contributing to a holistic view of their impact on society and the environment.

Analysis of Search Volume Data

To understand the popularity and consumer interest in these fast fashion brands, we analyzed the annual search volume data for each label included in the study. To conduct this analysis, we utilized Ahrefs, a reliable SEO tool known for its data accuracy. Ahrefs provided valuable insights into the frequency of searches for each brand throughout the study period.

This search volume data played a crucial role in evaluating the market presence and consumer awareness of these fast fashion companies. It served as a complementary element to our analysis of their financial performance and ethical practices, offering a well-rounded perspective on the brands’ overall impact and relevance in the eyes of consumers. By incorporating search volume data, we aimed to capture a comprehensive understanding of the fast fashion landscape, considering both quantitative metrics and consumer sentiment.

Conclusion

The Fast Fashion Index 2023 offers a well-rounded understanding of the fast fashion industry by integrating three key perspectives: Financial performance, Ethical and Sustainable practices, and Consumer interest. By evaluating the revenue and earnings of the top 50 brands, we gained insights into their economic success. The Brand Scoring System further allowed us to assess their commitment to ethical practices, considering sustainability, labor practices, ethical sourcing, and more. Finally, the Analysis of Search Volume Data provided a glimpse into consumer interest and market presence.

This multifaceted approach offers a clear and objective overview of the fast fashion scenario, giving due consideration to both the financial prosperity and ethical standing of the industry’s leading brands. The Fast Fashion Index 2023 serves as a valuable tool for understanding the multifaceted nature of the fashion industry, giving stakeholders and consumers insights into the market dynamics, ethical considerations, and consumer preferences.